pa local tax due dates 2021

Taxpayers should write 2021 Estimated Tax Payment and the last four digits of the primary. UF-1 Non-Resident Sports Facility Fee 4.

While the PA Department of Revenue and the IRS announced.

. Time for 2021 Filing. 1419 3rd Avenue PO Box 307 Duncansville PA 16635-0307. The PA Department of Revenue and the IRS announced that the income tax filing deadline for the final annual return 2020 is extended to May 17 2021.

Contact us to quickly and efficiently resolve your tax needs. That is Keystone will not apply late-filing penalty and interest on tax year 2020. Blair County Tax Collection Bureau.

Harrisburg PA With the deadline to file 2021 personal income tax returns a week away the Department of Revenue is reminding Pennsylvanians that th. The Department of Revenue is encouraging taxpayers to. We are Pennsylvanias most trusted tax administrator.

Personal Income Tax Filing Deadline for PA is May 17 2021 Harrisburg PA. Keystone Collections said today The Local Earned Income Tax filing deadline has NOT been extended beyond the April 15 2021 due date. FORM TAX TYPE TAX PERIOD DUE DATE.

BRADFORD TAX COLLECTION DISTRICT. To remain consistent with the federal tax due date the due date for filing 2021 Pennsylvania tax returns will be on or before midnight Monday April 18 2022. The quarterly due dates for personal income tax estimated payments are as follows.

The 2021 local earned income tax filing due date is April 18th 2022. Most state income tax returns are due on that same day. The local earned income tax filing deadline is accordingly extended to match the State and Federal date of May 17 2021.

Harrisburg PA The Department of Revenue today announced the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns and make final 2020 income tax payments is extended to May 17 2021. Tax Day Deadline 2022 for 2021 Tax Year Returns - see state related tax deadlines and payment information. Tax Day deadline is April 15 unless the date falls on a weekend or holiday then it is the next business day.

LS-1 Local Services Tax 12 December January 31. Start Date End Date Due Date. This means taxpayers will have an.

The personal income tax filing deadline was originally set for today April 15 2021 but the. April 18 2022 - not April 15 - is the IRS Tax Deadline or Tax Day for 2021 Tax ReturnsFor residents of Maine and Massachusetts the deadline is April 19 2022 due to the Patriots Day holiday in those states. Since the FCATB 2021 Individual Form 531 Local Earned Income and Net Profits Tax Return and related instructions were due to production well in advance of the PA DoR publishing its due date in the documents at the above-referenced website the FCATB issued its form with a due date of April 15 2022 but will process returns in accord with the PA.

All forms listed below should be filed with the City of Pittsburgh. The postmark determines date of mailing. If the 15th falls on Saturday Sunday or holiday the due date would be extended to the next business day.

We are the trusted partner for 32 TCDs and provide services to help Individuals Employers Payroll Companies Tax Preparers and Governments. 4th Quarter - January 15th. April 14 2021.

The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I Declaration of Estimated Tax coupon to the department along with their check for the estimated tax amount. Estimate due dates are. Federal income taxes for tax year 2021 are due April 18 2022.

AT Amusement Tax 12 December January 15. 11 rows BLAIR TAX COLLECTION DISTRICT. Pay all of the estimated tax by Jan.

2nd Quarter - June 15th. TAX PERIOD END DATES 03312021 06302021 09302021 12312021 04202021 07202021 10202021 01202022 TAX PERIOD DUE DATES Returns are to be filed whether or not taxable transac-tions occur in a period. 2021 Personal Income Tax Forms.

A handful of states have a later due date April 30 2022 for example. Income tax returns must be postmarked on or before the 2022 filing due date to avoid penalties and late fees. Or File a 2021 PA tax return by March 1 2022 and pay the total tax due.

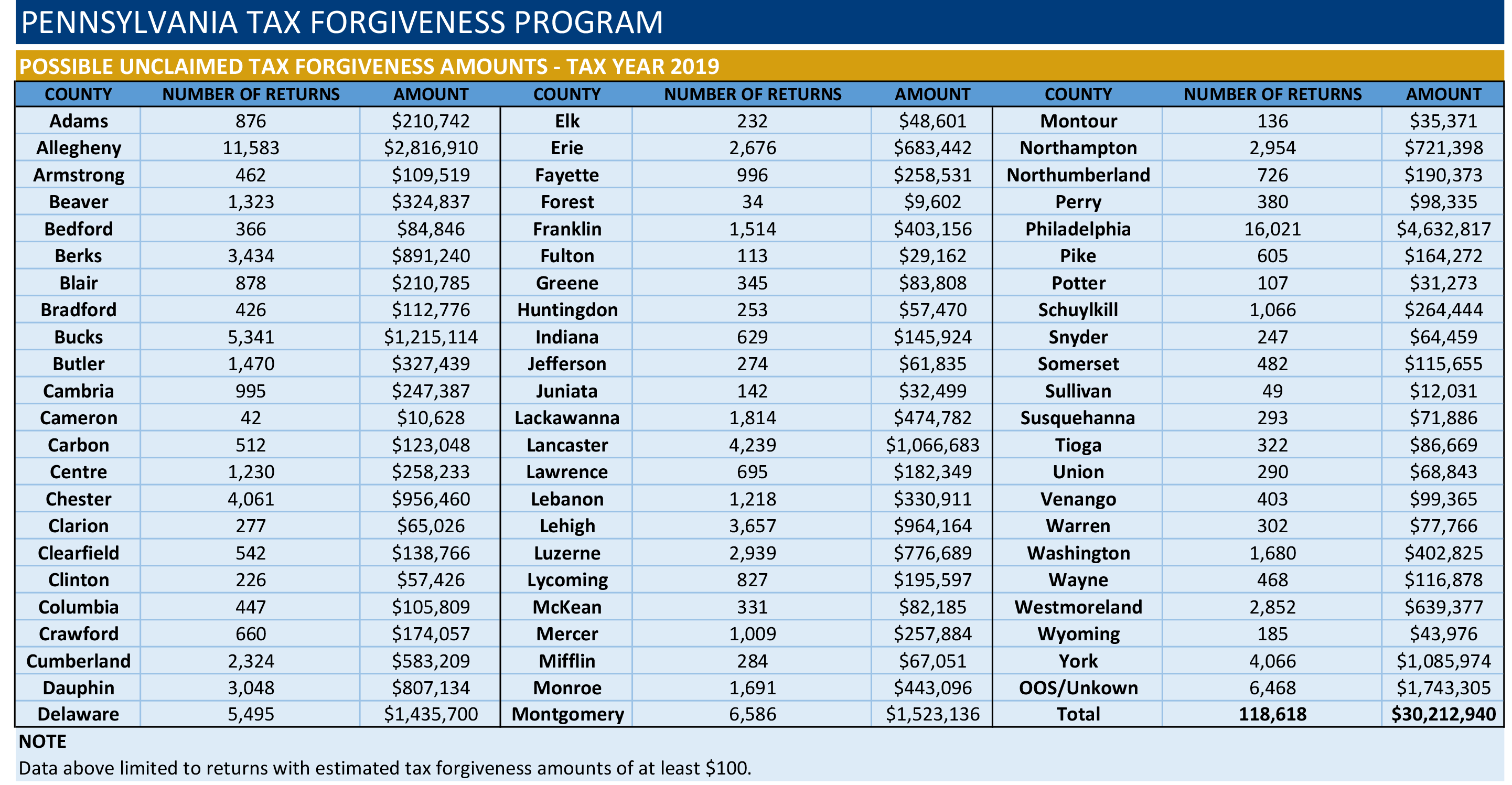

3rd Quarter - September 15th. The due date for fling extensions for tax year 2021 is October 17th 2022. TAX FORGIVENESS Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program.

File Your Local Earned Income Tax Return Online March 16 2022 Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by April 18 2022. 53 rows When Are Taxes Due. We specialize in all Pennsylvania Act 32 and Act 50 tax administration services.

Pennsylvania Extends Personal Income Tax Filing Deadline to May 17 2021. 1st Quarter - April 15th. AMENDING ESTIMATED TAX PAYMENTS An individual that has a change in income or credits during a tax year may be required to or elect to change or amend.

MyPATH a Free Option for PA Tax Returns and Payments. PT Parking Tax 12 December January 15. Forms may be obtained via the Taxpayer Forms and Info link at the top of this page or in person at our office.

In this case 2021 estimated tax payments are not required. E-TIDES File tax returns and remit payments to the. April 15 of the following year.

File and remit payments using one of the following electronic options.

Usa West Penn Power Utility Bill Template Bill Template Utility Bill Templates

Pennsylvania Department Of Revenue Parevenue Twitter

Certified Valuation Analyst In 2021 Cpa Accounting Accounting Firms Income Tax Preparation

Pennsylvania Property Tax H R Block

Pennsylvania Department Of Revenue

Pennsylvania Department Of Revenue Parevenue Twitter

Prepare And Efile Your 2021 2022 Pennsylvania Tax Return

Where S My Refund Pennsylvania H R Block

Pennsylvania Department Of Revenue Parevenue Twitter

Update To Montogmery County Common Level Ratio The Pennsylvania Department Of Revenue The Pennsylvania Department Of Revenu Veterans Id Card County State Tax

Pennsylvania Department Of Revenue

Pennsylvania Tax And Labor Law Guide In 2021 Labor Law Workers Compensation Insurance Employee Health

Pennsylvania Department Of Revenue

.png)